virginia state ev tax credit

The Fund shall be established on the books of the Comptroller. Beginning September 1 2021 a resident of the Commonwealth who is the purchaser of a new or used electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500 subject to the availability of funds in the Fund.

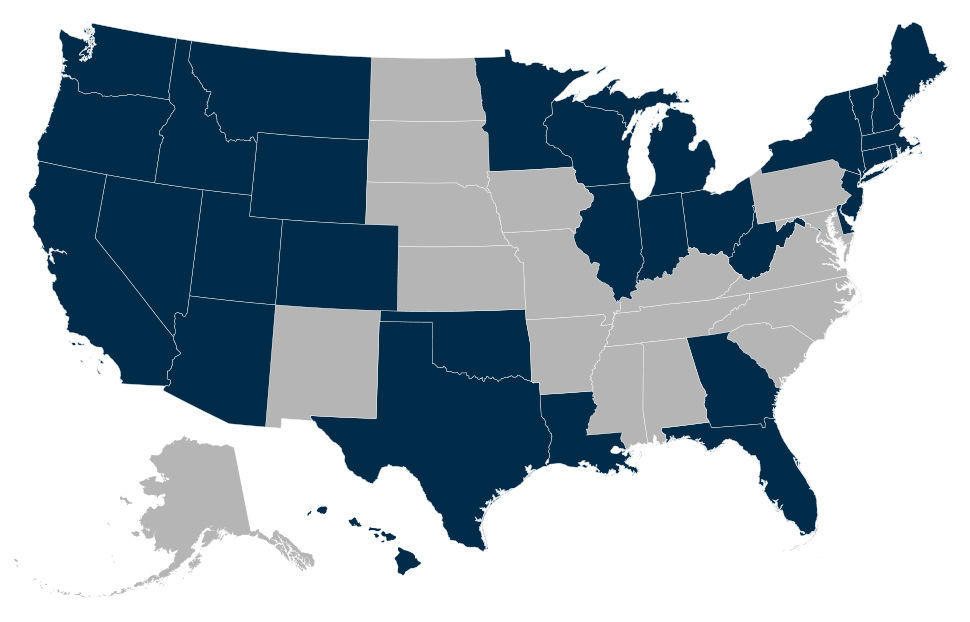

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

The Federal EV Charger Tax Credit program offers a rebate of 1000 per site.

. Ad Here are some of the tax incentives you can expect if you own an EV car. Tax credit plan aimed at encouraging Americans to buy electric vehicles would discriminate against European producers and break World Trade Organization rules. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle.

The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV. Tucson Electric Power offers a rebate of up to 300 as a bill credit for residential charger installation. Ad File Your State And Federal Taxes With TurboTax.

The incentives may vary by sector but in general there are programs for all types. The Federal Goverment has a tax credit for installing residential EV chargers. See Why Were Americas 1 Tax Preparer.

An earlier version of the budget passed by the. Virginias National Electric Vehicle Infrastructure NEVI Planning added 712022. Transit Emissions Reduction Grants.

Either fax your application to 804 367-6379 or mail it to. Information in this list is updated throughout the year and comprehensively reviewed annually after Virginias legislative session ends. Under the Inflation Reduction Act nearing final approval in the US.

There is hereby created in the state treasury a special nonreverting fund to be known as the Electric Vehicle Rebate Program Fund. This page lists grants rebates tax credits tax deductions and utility incentives available to encourage the adoption of energy efficiency measures and renewable or alternative energy. 17 hours agoAn electric vehicle charges at a charging station at the Capitol in Salt Lake City on March 29.

Up to 1000 state tax credit Local and Utility Incentives. By Associated Press Aug. Effective October 1 2021 until January 1 2027 Electric Vehicle Rebate Program Fund.

The Virginia State Corporation Commission may not set the rates charges or fees for retail EV charging services provided by non-utilities. DMV Registration Work Center. SRP and APS offer reduced electricity rates based on time-of-use charging for EV owners.

Congress a tax credit of up to 7500 could. April 2022 State Incentives. A tax credit of up to 7500 could be used to defray the cost of an electric vehicle under the Inflation Reduction Act now moving toward final approval in Congress.

Download and complete the License Plate Application VSA 10 including the vehicle identification number VIN and title number. The European Union criticized the USs proposed electric vehicle tax. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle.

Included are EVSE tax credits and Level 2 EV charging rebates as well as rebates for electric cars. Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia. An enhanced rebate of 2000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines.

If the purchaser of an EV has an income that doesnt exceed 300 percent of the federal poverty level they can get an extra 2000 on their. The incentive may cover up to 30 of the project cost. The rebate program covers Level 1 Level 2 and Level 3 chargers.

Beginning September 1 2021 a qualified resident of the Commonwealth who is the purchaser of a new. Driving an electric car now comes with added benefits for driving a clean car. 5 hours agoThe state of Virginia is offering residents who owe a tax liability from 2021 a rebate of up to 250 for people who filed individually and up to 500 for joint filers.

Check that your vehicle made the list of qualifying clean fuel vehicles. See If You Qualify To File State And Federal For Free With TurboTax Free Edition. Electric Vehicles Solar and Energy Storage.

In addition to local incentives the federal rebate for electric cars applies to all fifty states. If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500. Reference House Bill 443 2022 and Virginia Code 56-121 and 56-23221.

In its final form the program which would begin Jan. Virginias National Electric Vehicle Infrastructure NEVI Planning. Residential customers small and large businesses and government agencies.

Learn more about the Federal Tax Credit. Reduced Vehicle License Tax and carpool lane access. 1 day agoBRUSSELS AP The European Union expressed concern Thursday that a new US.

If you have any questions read our FAQ section.

Virginia Ev Rebate Legislation Proposed In 2021 Pluginsites

Is There A Virginia Electric Vehicle Tax Credit Mini Of Sterling

Tax Credit For Electric Vehicle Chargers Enel X Way

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

Electric Vehicle Tax Credit Guide Car And Driver

Canada Made Evs To Qualify For Tax Credits In U S After All Automotive News Canada

Nissan Increases The Rebate On The 2019 Leaf To 3 500 Virginia Clean Cities

Electric Vehicle Incentives By State Polaris Commercial

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Rebates And Tax Credits For Electric Vehicle Charging Stations

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

![]()

The 50 States Of Electric Vehicles State Lawmakers Focus On Incentives Fees And Government Procurement In Q1 2021 Nc Clean Energy Technology Center